Investing in Cambodia’s Resort & Retreat Lodging Sector: What Investors Need to Know

Cambodia’s resort and retreat lodging market is gaining renewed investor attention. Tourism has rebounded, new airports are reshaping accessibility, and travelers are increasingly choosing experiential, nature-based escapes over conventional hotels. For investors, this creates a compelling window—especially in eco-luxury, riverside, and boutique retreat segments.

Here is a clear, summarized investor guide to what matters most in 2025–2030.

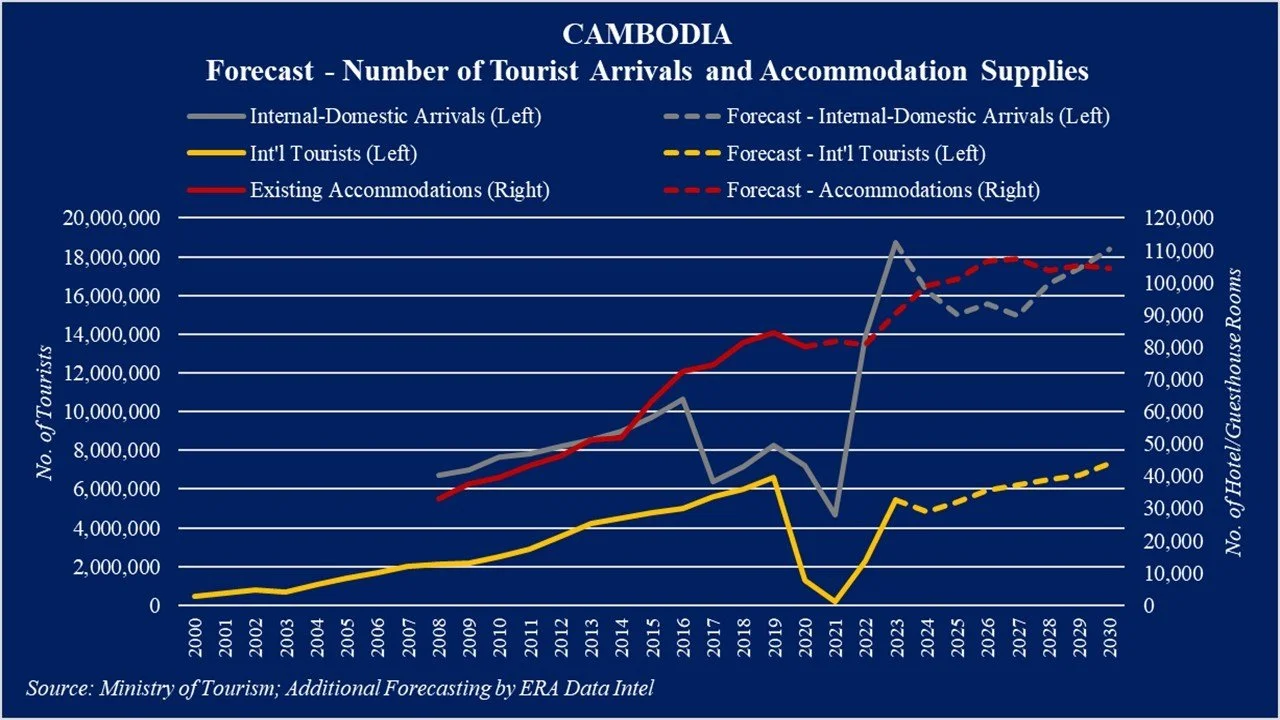

1. Demand Is Rising Quickly

2019: 6.61M international tourists

2024: 6.70M (exceeded pre-COVID peak)

2025 (Jan–Aug): ~4M already

Supported by:

Investor Insight: Cambodia’s tourism infrastructure now supports large-scale, long-term hospitality growth.

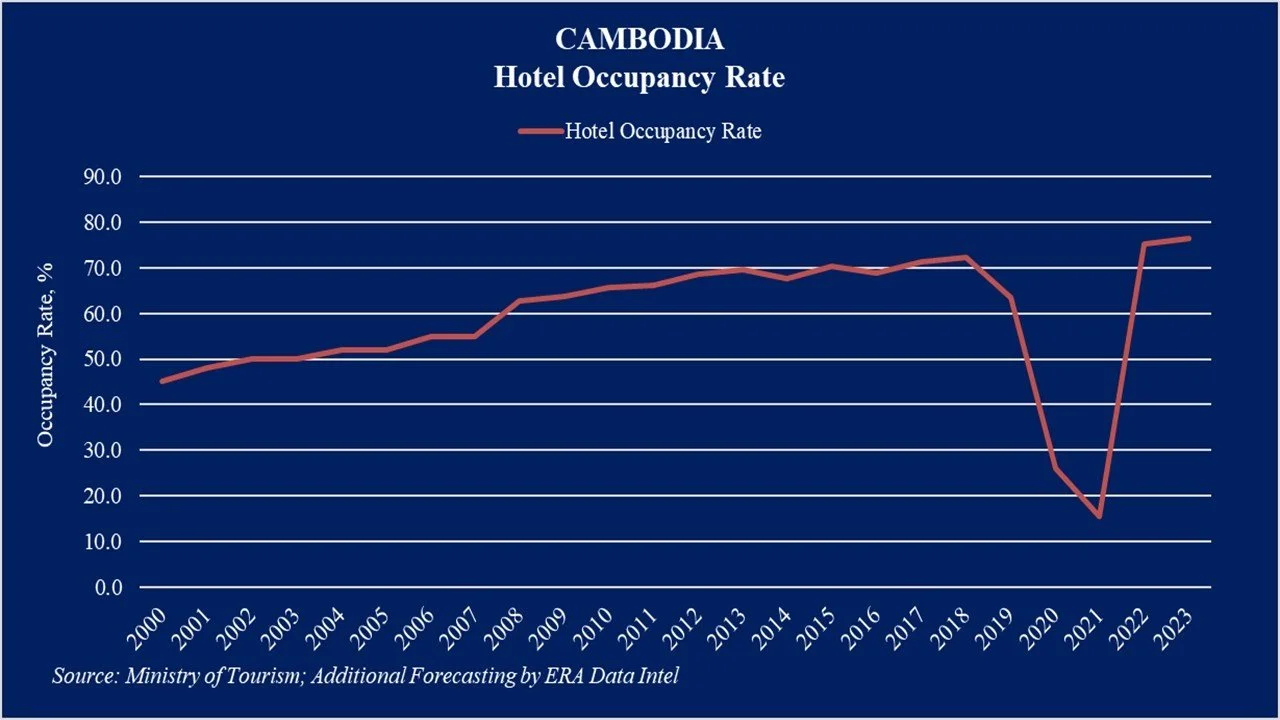

2. Resort Market Performance Is Strengthening

Phnom Penh 2024 hotel occupancy: ~78%

Siem Reap forecast (2027): ~60%

Coastal visitors (Jan–Aug 2025): 6.63M

Eco-zone visitors: +28.6% YoY

Conclusion: Demand is back across all segments—coastal, cultural, and eco-retreats—with nature-based properties gaining traction the fastest.

3. Where the Strongest Opportunities Are

A. Island & Coastal Resorts

Koh Rong, Samloem, Kep, Kampot → strong ADR, limited supply.

B. Eco-Retreats & Riverside Lodges

Cardamom Mountains, Koh Kong, Mondulkiri → high appeal for wellness and nature travelers.

C. Boutique Cultural Lodges

Siem Reap expanding into wellness, riverside hotels, and lifestyle retreats.

Investor Insight: The highest-performing assets are small to mid-scale, experiential, and nature-integrated.

4. Investment Formats Worth Considering

Eco-luxury resort / tented lodges

Boutique villas & riverside retreats

Island resorts

Strata-resort units with rental pool

Agro-eco retreat concepts

These models align strongly with global travel trends: authenticity, nature, wellness, and digital-detox experiences.

5. Key Legal Notes for Foreign Investors

Foreigners can own strata units but cannot directly own land.

Land-based resorts use:

Eco-zones require EIAs and environmental compliance.

USD-based economy minimizes currency risk.

6. Risks to Evaluate Carefully

Source-market dependency (China/ASEAN/Domestic)

Reputation and governance concerns

Seasonality in coastal markets

Environmental constraints & compliance

Historical overbuilding in select locations (e.g., Sihanoukville)

Investor Insight: Success depends on conservative underwriting, sustainable development, and strong operators.

7. What Serious Investors Analyze

ADR and occupancy benchmarks

Access and transportation improvements

Build cost per key

Demand mix: domestic vs international

3–5 year ramp-up to stabilization

NOI, IRR, and downside stress-testing

In short: data-driven feasibility is essential.

A Rare Opportunity for Serious Resort Investors: Prek Angkunh Riverside Retreat (Koh Kong)

As Cambodia’s eco- and nature-based tourism segment rises, high-quality riverside retreats are becoming exceptionally valuable. I am currently representing a turn-key eco-luxury resort ideal for investors seeking immediate operation or future repositioning.

Prek Angkunh Riverside Retreat — Investment Summary

Asking Price: USD 950,000 (Negotiable) Turn-key, operational resort on a hard-title riverfront estate

Location

Prek Angkunh Village, Trapeang Rung Commune, Koh Kong Province

3.5 km from NR48

500 m concrete access road to the main gate

Quiet, natural river retreat surrounded by forest

Buildings & Structures

6 stand-alone guest villas (stilted round bungalows)

3 staff rooms

Open lounge hall

Dining hall (6m × 15m)

Cinema room (private movie room)

2 warehouses

Modern entrance gate + full perimeter fencing

Outdoor & Leisure Facilities

8m × 22m premium tiled swimming pool

Private river deck (events, sunsets, kayaking)

Elevated timber walkways

2 outdoor bathrooms (M/F)

Tropical garden with fruit trees

Kayaks (6), fishing boat, sunset cruising deck

Camping area with 6 tents

Systems & Equipment

63 kVA state power + 63 kVA generator

Water storage, filtration & purification system

Ice machine (50 kg/day)

5-star hotel linens & amenities

17 CCTV cameras

Australian lightning protection system (x2)

Kitchens & Hospitality

Equipped guest kitchen

Full staff kitchen

Commercial coffee machine

Complete cooking & dining ware

Why This Resort Deserves Investor Attention?

Hard-title riverfront land (rare in Koh Kong)

Fully operational, turn-key eco-retreat

Large land plot suitable for expansion

Perfect for wellness, yoga, detox, riverside escape, boutique resort, or adventure lodge

Proximity to NR48 and gateway to Cardamom Mountains

Rising demand for authentic nature-based stays

Interested in this resort?

I can provide the full investment brief, detailed financials, and arrange a private tour of the property.

📩 Feel free to message me directly for confidential investor materials.

Hoem Seiha — ERA Cambodia | Luxury Residence & Investment Advisor

Call: +855-10-699-553

Telegram: t.me/hoemseiha_era

WhatsApp: wa.me/85510699553

Line ID: hoemseiha

Email: hoem.seiha@eracambodia.com

More condo listings: t.me/seiha_era_condo_listing