Rental Yield in Cambodia: What It Is and How to Calculate It

If you’re thinking about investing in Cambodian real estate—especially in growing markets like Phnom Penh, Siem Reap, or Sihanoukville—understanding rental yield is key. Rental yield is a simple but powerful metric that helps you measure the return on your property investment, based solely on the rental income you generate.

Here’s what you need to know:

✅ What Is Rental Yield?

Rental yield is the annual return you earn from renting out a property, expressed as a percentage of the property’s value. It tells you how much cash your property generates relative to what you paid for it.

In Cambodia, gross rental yields (before expenses) typically range from:

6% to 9% for well-located condos in Phnom Penh, Siem Reap and Sihanoukville

Up to 10% for affordable units in emerging areas with high rental demand

✅ How to Calculate Rental Yield

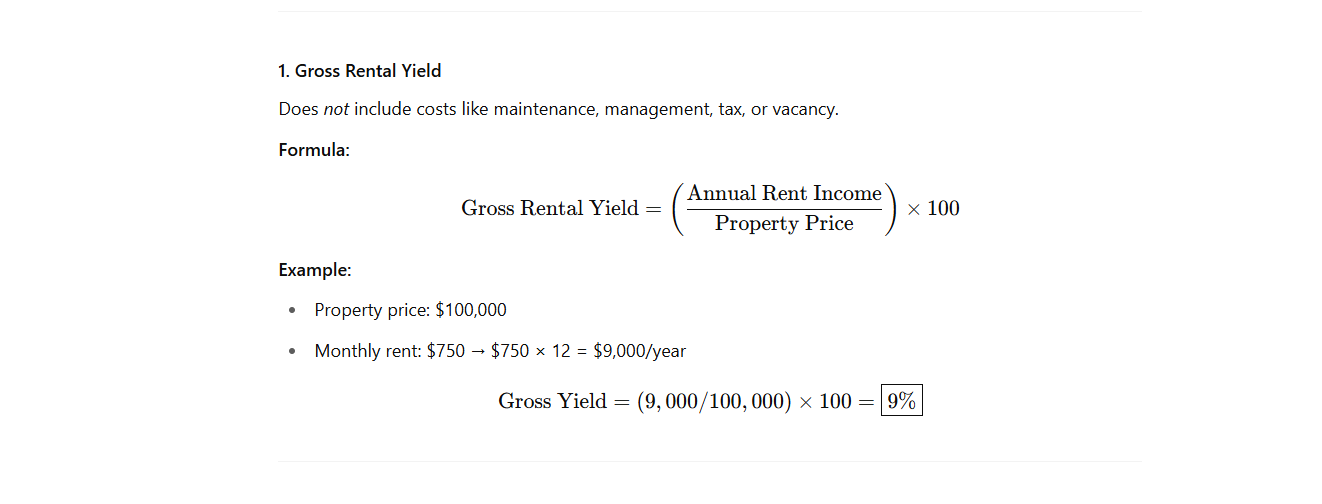

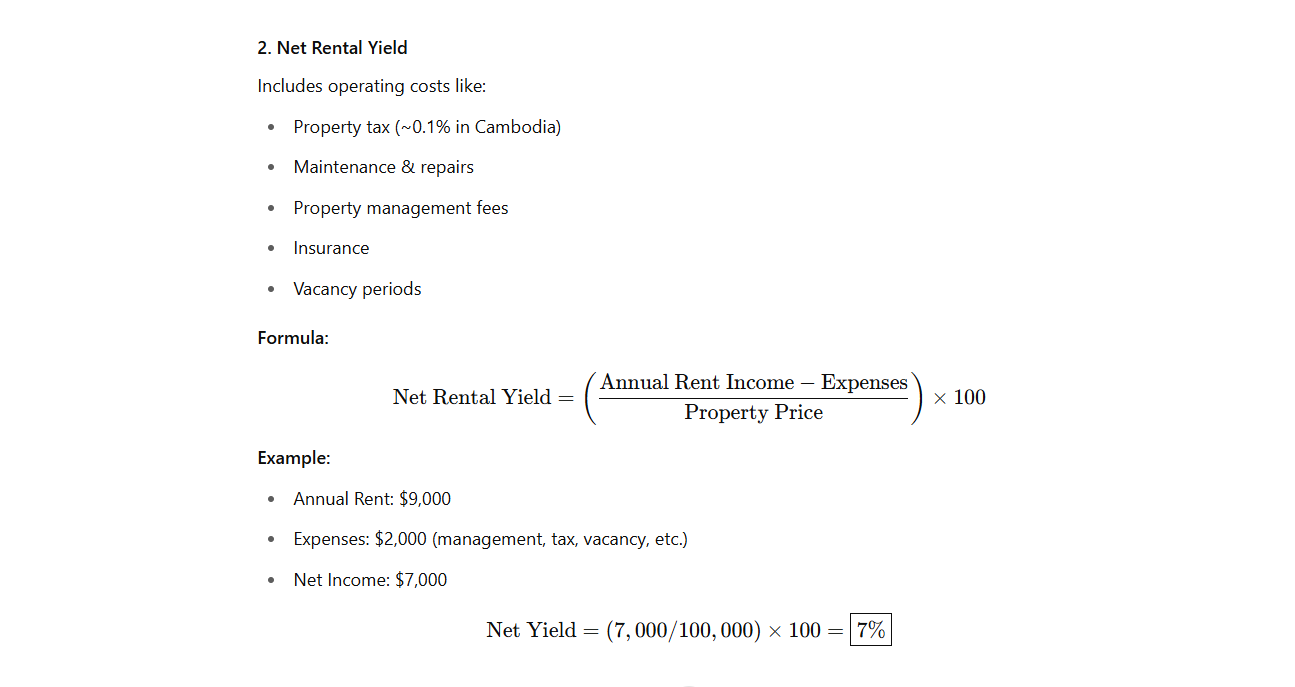

There are two common types:

✅ Why Rental Yield Matters in Cambodia

Helps compare investment performance between properties

Reveals if you’re getting enough income to cover expenses or mortgage

Allows you to benchmark Cambodian property vs. other countries or markets

✅ Tips for Maximizing Rental Yield in Cambodia

Buy in high-demand districts: BKK1, Toul Kork, Chory Changva

Avoid over-priced luxury condos with low occupancy

Furnish your units to attract expat or Airbnb tenants

Work with experienced property managers to reduce vacancies and maintenance issues

A good rental yield in Cambodia is 6–9%+, but the net yield is what really matters after costs. Always analyze both the income potential and hidden expenses before making a real estate decision.

Need help calculating or comparing yield for a specific property?

Contact ERA Cambodia—your trusted local partner in real estate investment.