Is Now the Right Time to Invest in Cambodian Property? Here’s What the Data Says

After a few challenging years marked by global uncertainties and local market corrections, Cambodia’s real estate market is showing encouraging signs of stabilization and recovery. But is it a good time to step in as an investor? Let’s break it down using real data and recent market trends.

Property Prices: Have We Hit the Bottom?

A look at average condominium prices from 2013 to early 2025 shows a clear cooling-off period after peaking around 2019–2020. Average condo prices declined moderately post-pandemic, stabilizing in the last two years.

Affordable Condominiums - Phnom Penh's Peri-Urban Areas -- For new condominium launches in suburban areas, both average condo price index and new launch prices fell below broad money, which translates to a more liquidity in real estate purchase than the past few years. Despite the fact, although more money in the economy which can be accessible by buyers, market confidence also play a crucial role for bolstering the demand. Looking a the data, condominium developments in the suburbs are more affordable in regards to liquidity signals this year.

Money supply (M2) for Cambodia as a whole; Condominium prices are for Peri-urban areas of Phnom Penh only.

Premium Condominiums - Phnom Penh's CBD Areas -- For new condominium launches in central business districts, prices are still high in the last few years but the curve converged in 2025 which indicates a bit of good sign for ability for local buyers buy premium condominiums this year.

Money supply (M2) for Cambodia as a whole; Condominium prices are for Phnom Penh's Central Business Districts.

This downward correction means the market has become more accessible to buyers, especially first-time investors looking for lower entry points.

Broad Money (M2): Liquidity is Growing

Another key signal is Cambodia’s Broad Money (M2) trend — a measure of money supply in the economy. M2 has seen robust growth, rising steadily from 8 (2013) to over 59 (mid-2024).

When M2 increases faster than property prices, it means more capital is circulating in the economy than is being absorbed by real estate.

This excess liquidity often finds its way into assets like property, pushing up demand over time.

In our recent data plots, we saw that while condo prices cooled off, M2 continued to grow. This divergence indicates that the market still has room to absorb fresh demand — a healthy sign for potential appreciation.

Money Supply and Contribution to broad money by category-Cambodia

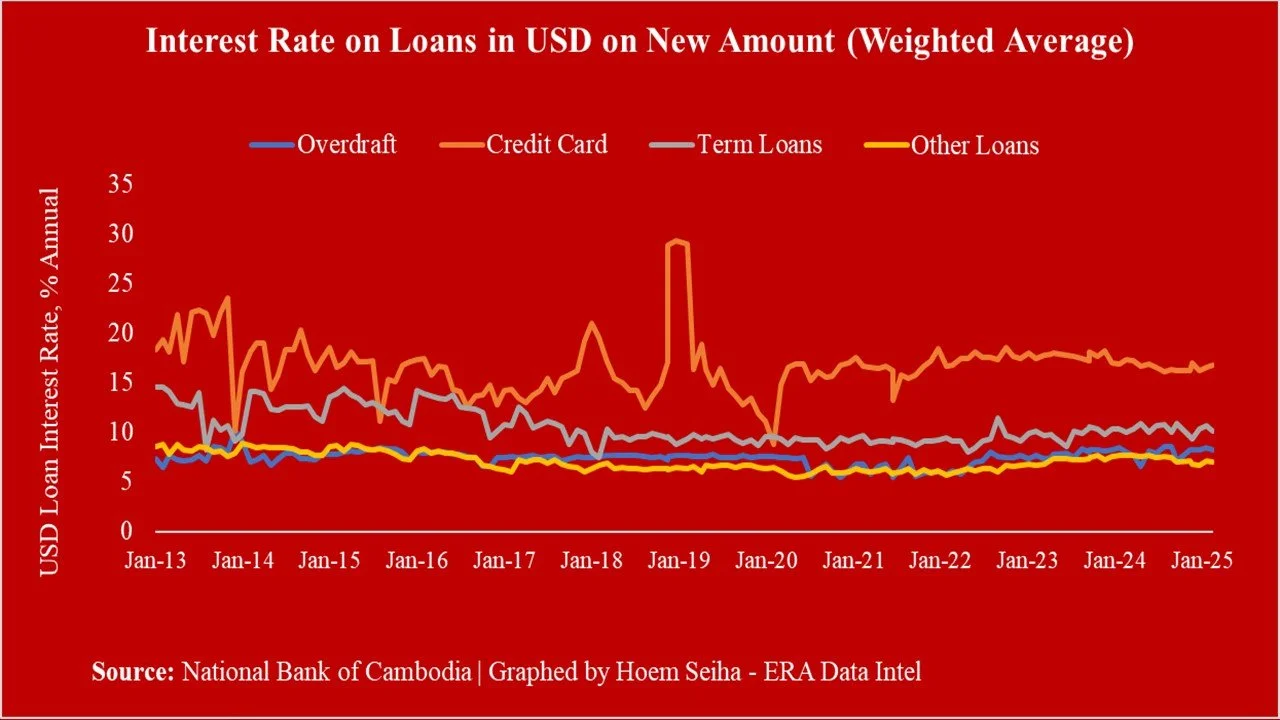

Interest Rates: Attractive for Borrowers

Cambodia’s lending rates have gradually become more competitive. While still higher than in some developed countries, they are low relative to regional peers. Lower rates mean:

Cheaper mortgages for buyers

Lower holding costs for investors

Higher leverage potential to maximize ROI

Combined with stable prices, this makes property investment more appealing now than during the high-rate, high-price period of 2018–2019.

Interest rates on new loans, denominated in US Dollars.

Market Sentiment: Stabilization and Recovery

Recent sales data, developer reports, and on-the-ground agent insights point to a cautious but improving sentiment:

Developers are reviving paused projects.

New launches focus on mid-tier and affordable units, matching real demand.

Foreign buyers, especially from ASEAN, are returning as travel resumes.

This gradual return of confidence supports a steady, sustainable recovery rather than a risky bubble.

Which Segments Are Most Attractive?

Based on current trends, here’s a quick look at some investment opportunities:

Different segments for condominiums and reasons why they are attractive for investments

Therefore, Is Now a Good Time to Buy?

In short: Yes, if you have a medium- to long-term view. Prices are reasonable, liquidity is strong, borrowing costs are acceptable, and demand drivers are normalizing. These conditions make 2024–2025 an attractive window to acquire well-located, income-generating properties before the next upward cycle.

As always, smart investors should:

Choose established or trusted developers.

Focus on prime or emerging locations.

Consider unit sizes and layouts that match current rental demand.

Do due diligence and get local expert advice.

Before You Leave

Real estate is a cyclical market — the best returns come when you buy during the recovery phase, not at the peak. Based on all the macro and micro indicators, Cambodia’s real estate market is positioning itself for a healthy rebound.

> Contact Our Consultant:

Name: Mr. Hoem Seiha

Analog call: 010-699-553 / +855-12-699-553

Telegram: http://t.me/Hoemseiha

WhatsApp: https://wa.me/85510699553

Line ID: hoemseiha

Email: hoem.seiha@eracambodia.com

Condo listings on Telegram channel: https://t.me/seiha_era_condo_listing