Buying a Condominium with GRR in Phnom Penh: What Developers Mean and How It Works

Investing in a condominium has become an increasingly attractive option in Phnom Penh, especially for investors seeking rental income without the day-to-day management burden. One term you will often see in project promotions is GRR — Guaranteed Rental Return. But what does it truly mean? How does it work? And what should you look out for before deciding?

This article breaks down GRR in a clear, practical way, with examples and key terms commonly used in the market.

What is GRR (Guaranteed Rental Return)?

A Guaranteed Rental Return (GRR) is a developer-backed rental income assurance that promises the buyer a fixed return on the property for a specified period, regardless of actual occupancy or rental performance. GRRs are typically marketed to passive investors who want stable income without needing to manage tenants.

In simpler terms:

You buy the condo → the developer (or operator) rents it out → you receive a guaranteed percentage every year.

Typical GRR Structure

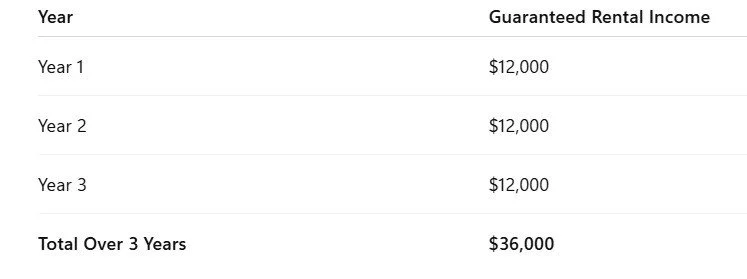

Example: GRR Model for a Phnom Penh Condominium

Let’s say an investor buys a unit at $150,000 with an 8% GRR for 3 years.

Guaranteed Return Calculation:

Annual Return = $150,000 × 8% = $12,000 per year Monthly Income = $12,000 ÷ 12 = $1,000 per month

Even if the market slows or occupancy is low, the investor still receives this income.

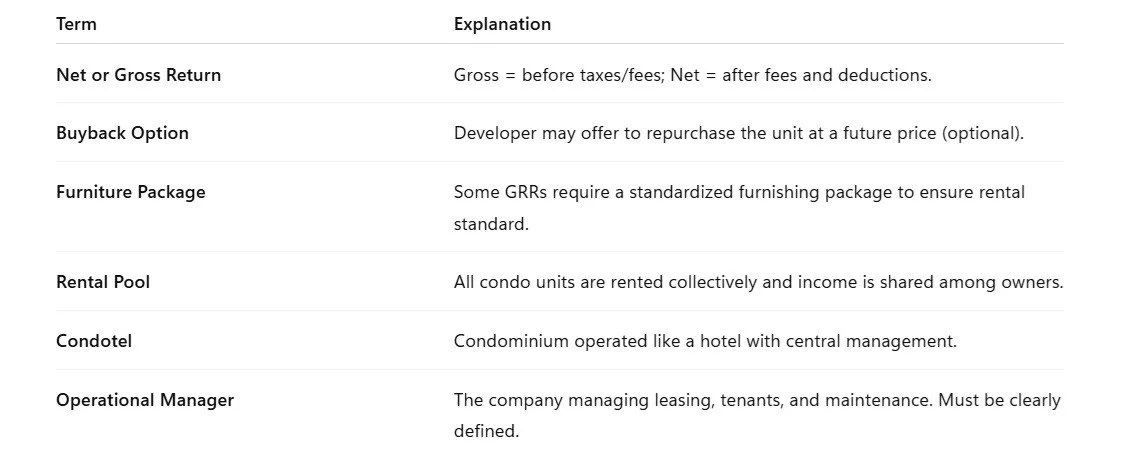

Key Terms Every Investor Should Know

Why Developers Offer GRR

Developers use GRR to:

Stimulate investor confidence

Speed up sales and secure early capital

Position the project as an investment property, not only a residence

Compete with other condominium projects in the market

Advantages for Buyers

Benefits

Predictable, passive rental income

Lower risk in a slow or unstable rental market

No need to manage tenants or property operations

Often includes free hotel-style stays for owners

Key Risks and What to Check Before Buying

GRR is not risk-free. Investors should ask:

Who is providing the guarantee? Developer or hotel operator?

Is the GRR reflected in the unit price? Some prices include a premium to cover the guarantee.

Financial stability of developer/operator — can they honor the payout long term?

Contract terms — what happens if developer delays, defaults, or stops operation?

Maintenance and sinking fund fees — who pays?

Tax obligations for rental income.

Quick Investor Evaluation Checklist

Before signing, verify:

☑ Developer reputation and track record

☑ Licensed management operator

☑ Real occupancy potential in the district (don’t rely purely on GRR promise)

☑ Contract languages: default clauses, exit clauses, taxation

☑ Payment schedule transparency and bank transfer records

GRR in the Phnom Penh Condo Market

GRR offerings became popular during the condominium boom between 2016–2023, especially in districts like: BKK1, Tonle Bassac, Chroy Changvar (OCIC Zone), Koh Norea, Sen Sok, and so on.

Many units were marketed as serviced apartments targeting expats, business travelers, and long-stay renters.

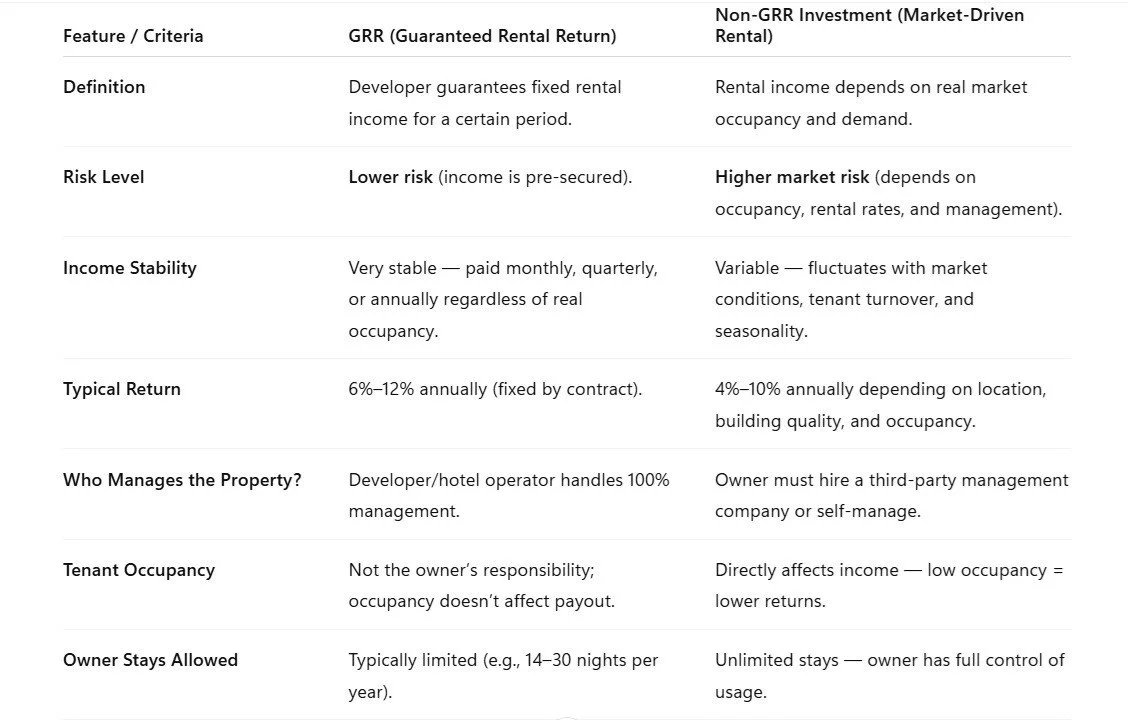

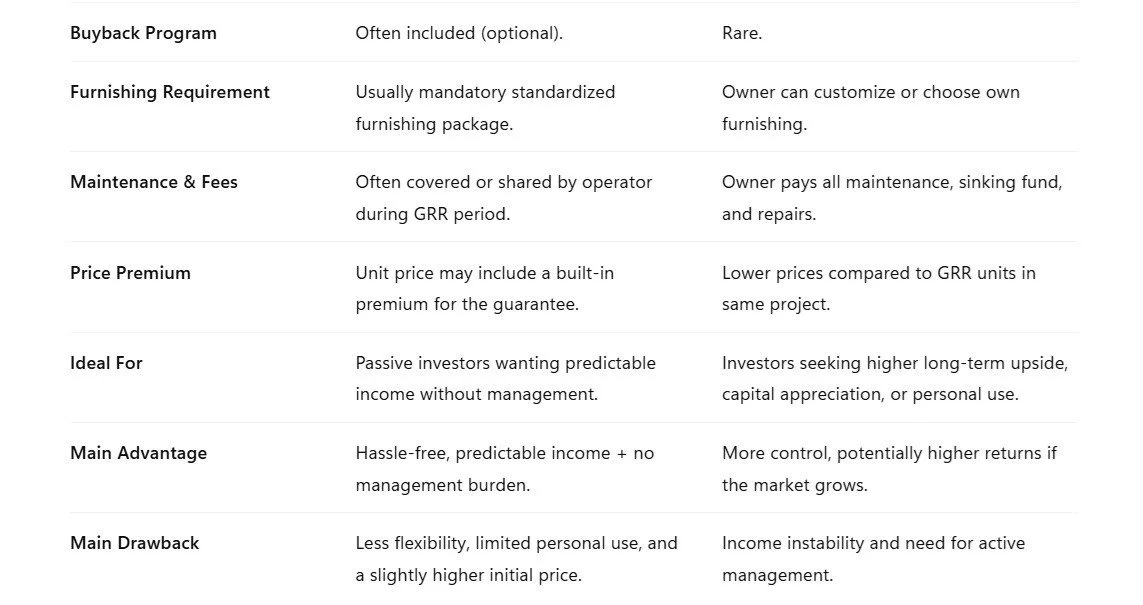

Comparison Chart: GRR vs. Non-GRR Condominium Investments

Final Thoughts: GRR is a Tool, Not a Guarantee of Success

A Guaranteed Rental Return can be a valuable investment mechanism when:

The developer is financially strong

Market demand exists for rental stays

Contracts are well-structured and transparent

But it is important to remember:

GRR should support the investment decision—not replace due diligence.

Interested in Condos with GRR in Phnom Penh?

If you are exploring investment condominiums, penthouses, or luxury serviced residences with sustainable returns, I am happy to advise you with market data and curated opportunities.

Hoem Seiha Curator of Luxe Residences | ERA Cambodia

Analog call: +855-10-699-553

Telegram: http://t.me/hoemseiha_era

WhatsApp: https://wa.me/85510699553

Line ID: hoemseiha

Email: hoem.seiha@eracambodia.com

Condo listings on Telegram channel: https://t.me/seiha_era_condo_listing