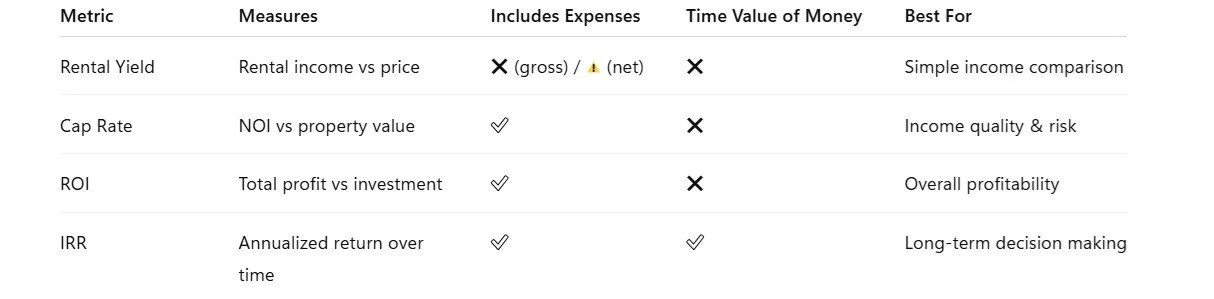

Cap Rate, ROI, Rental Yield & IRR Explained: How Smart Property Investors Really Measure Returns

Whether you are investing in property for passive income (rental yield, GRR, long-term holding) or active income (value-add, flipping, redevelopment), investors often ask the same core questions:

What is the cap rate?

What is the rental yield?

What is my return on investment (ROI)?

What about IRR — is it more important?

These terms are frequently used in brochures and sales pitches, but they are not interchangeable. Each measures a different aspect of investment performance. Understanding them correctly is essential for making sound decisions — especially in a market like Phnom Penh, where returns vary widely by location, product type, and strategy.

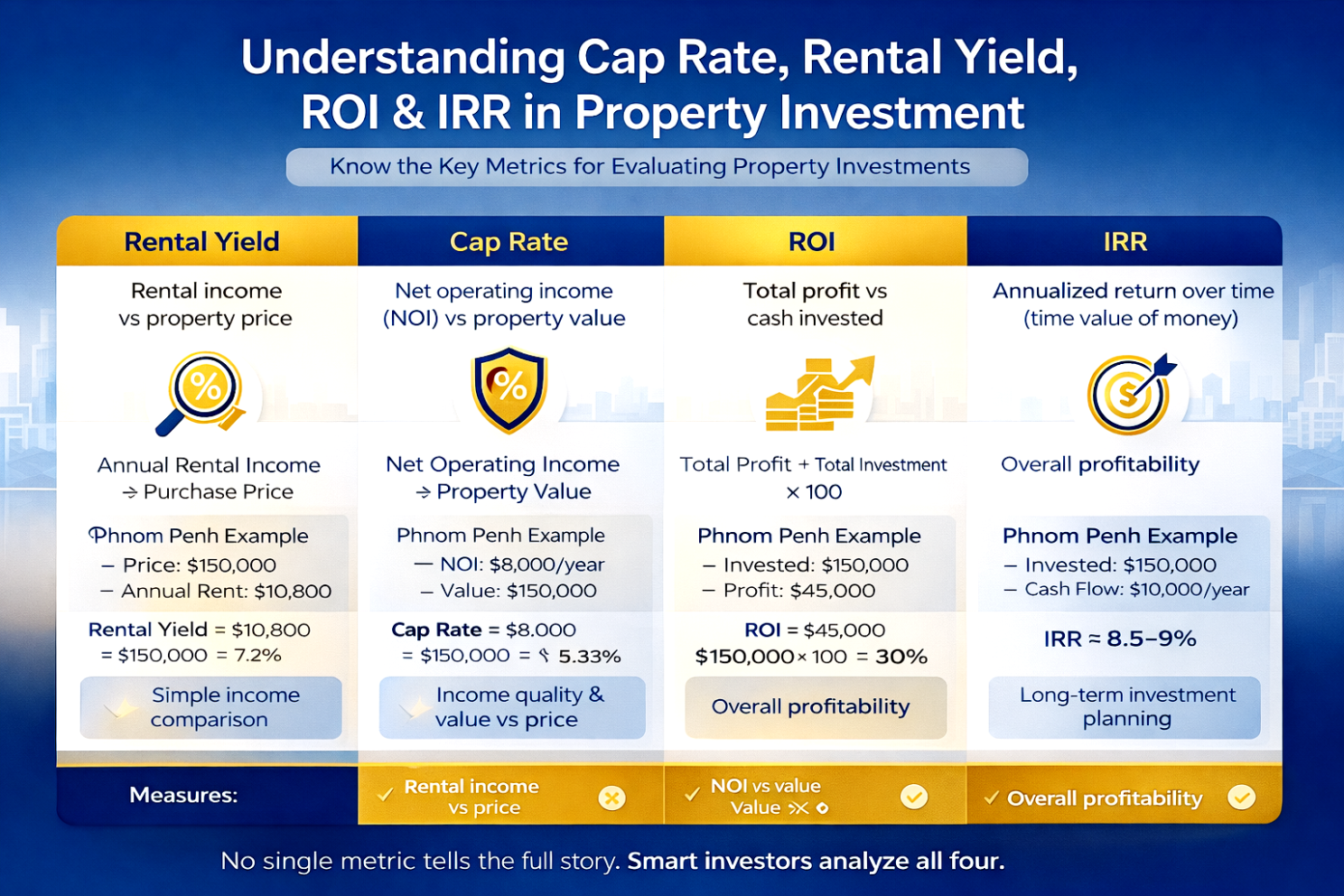

1. Rental Yield — The Starting Point for Income Investors

> What Is Rental Yield?

Rental yield measures how much rental income a property generates relative to its purchase price.

Formula: Rental Yield (%) = Annual Rental Income ÷ Purchase Price

Example (Phnom Penh Condo)

Purchase price: $150,000

Monthly rent: $900

Annual rent: $10,800

👉 Rental Yield = $10,800 ÷ $150,000 = 7.2%

> How to Interpret It

Gross rental yield (before expenses) is often used in marketing

Net rental yield (after management, maintenance, tax) is more realistic

In Phnom Penh, realistic net yields often fall between 4.5%–7%

✔ Best used for: Simple income comparison between properties

2. Capitalization Rate (Cap Rate) — Income vs Value

> What Is Cap Rate?

Cap rate measures the net operating income (NOI) of a property compared to its market value.

Formula: Cap Rate = Net Operating Income ÷ Property Value

NOI = Rental income after operating expenses, but before financing

> Example

Annual rent: $10,800

Operating expenses (management, maintenance, vacancy): $2,800

NOI = $8,000

Property value: $150,000

👉 Cap Rate = $8,000 ÷ $150,000 = 5.33%

> How to Interpret It

Cap rate reflects risk and income quality

Lower cap rate = lower risk / prime area (e.g., BKK1)

Higher cap rate = higher risk / emerging area

✔ Best used for: Comparing income-producing properties regardless of financing

3. Return on Investment (ROI) — Total Profit Perspective

> What Is ROI?

ROI measures the total profit made from an investment compared to the total cash invested.

Formula: ROI (%) = (Total Profit ÷ Total Investment) × 100

> Example

Purchase price: $150,000

Rental income over 3 years: $30,000

Selling price after 3 years: $165,000

Total profit = $45,000

👉 ROI = $45,000 ÷ $150,000 = 30% total ROI (≈ 10% average per year, not time-weighted)

> How to Interpret It

ROI is simple and intuitive

Does not consider time value of money

Does not show cash flow timing

✔ Best used for: Quick performance snapshots

4. Internal Rate of Return (IRR) — The Most Complete Metric

> What Is IRR?

IRR measures the annualized return of an investment over time, considering:

Cash inflows

Cash outflows

Timing of each cash flow

IRR is widely used by institutional investors, developers, and sophisticated buyers.

> Example (5-Year Holding)

Initial investment: –$150,000

Annual rental income: +$10,000 (years 1–5)

Sale in year 5: +$170,000

👉 IRR ≈ 8.5%–9% annually

> How to Interpret It

IRR accounts for when money is received

Best for comparing long-term investments

Sensitive to exit assumptions

✔ Best used for: Long-term investment planning & comparing multiple strategies

Phnom Penh Market Context

In Phnom Penh:

Rental Yield & Cap Rate matter most for condos and serviced apartments

ROI & IRR matter more for development, value-add, and long-hold investors

GRR projects often show artificially strong yields, but IRR reveals the real return

Prime locations (BKK1, Tonle Bassac) usually offer lower yields but stronger capital preservation

Emerging areas may show higher yields but carry higher vacancy and exit risk

Final Thoughts

No single metric tells the full story.

Rental yield answers: How much income will I get?

Cap rate answers: Is the income worth the price?

ROI answers: How much profit did I make?

IRR answers: Was this investment worth my time and risk?

A smart property investor looks at all four together, not just the highest number in a brochure.

Want help analyzing a property using real data?

I regularly help clients evaluate condos, penthouses, and investment assets using market-based yield, cap rate, and IRR analysis — not marketing figures.

Hoem Seiha, ERA Curator of Luxe Residences | ERA Cambodia

Analog call: +855-10-699-553

Telegram: http://t.me/hoemseiha_era

WhatsApp: https://wa.me/85510699553

Line ID: hoemseiha

Email: hoem.seiha@eracambodia.com

Condo listings on Telegram channel: https://t.me/seiha_era_condo_listing