Cambodia’s Real Estate Market & Prospect 2026: Navigating Challenges, Risks, and Opportunities

As Cambodia heads into 2026, the country stands at a pivotal moment in its economic and real-estate evolution. Growth remains intact, new infrastructure is coming online, and foreign investment continues to diversify — yet this progress unfolds within a complex landscape of risks, global tensions, and structural changes at home.

For investors, developers, and homeowners, understanding these dynamics is essential. Below is a comprehensive yet condensed outlook on Cambodia’s economy, tourism, geopolitical environment, legal framework, and real-estate market, and where opportunities genuinely lie.

1. Cambodia’s Economic Outlook: From Post-Pandemic Recovery to Sustainable Growth

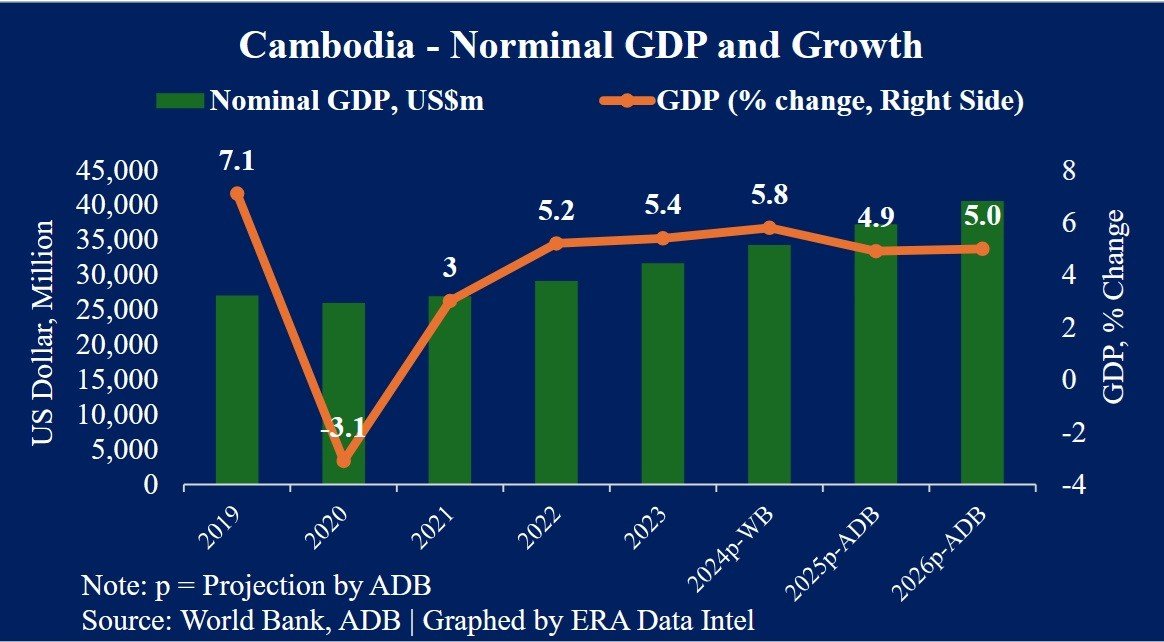

GDP: Historical Trend & Forecast

Over the past decade, Cambodia has consistently ranked among Asia’s fastest-growing economies.

2010–2019: Average growth of 6%–7%, driven by garments, construction, and tourism.

2020: Global pandemic contraction.

2021–2024: Recovery resumed, with GDP rising 5.4% in 2023, 5.8% projected for 2024, and 4.9% for 2025.

2026 Forecast: Growth expected to reach ~5%, supported by exports, tourism revival, and infrastructure expansion.

GDP Composition & 2026 Sector Prospects

Agriculture: ~22–25% of GDP — growing more slowly but increasingly modernised.

Industry: ~33–38% — supported by manufacturing diversification as global supply chains shift toward ASEAN.

Services: ~35–42% — tourism, transport, finance, and digital services will be key movers in 2026.

Drivers of Growth (2026 Onwards)

Export diversification: Electronics, assembly, auto parts, and garment-plus manufacturing.

Tourism rebound with new airports and upgraded connectivity.

FDI expansion into manufacturing, logistics, and selective real estate.

Young demographics fueling urbanisation and domestic consumption.

2. Tourism: The Comeback Engine for Real Estate

Tourist Arrivals: 2010–2025

Tourism has always been one of Cambodia’s strongest engines.

6.6 million visitors in 2019 (pre-COVID peak).

Sharp decline in 2020–2021, followed by a robust rebound.

6.7 million visitors in 2024, nearly fully restored.

2025 saw fluctuations due to border tensions and regional image issues.

2026 Tourism Prospect

The outlook is positive, supported by:

Full operation of Techo International Airport (TIA) in Phnom Penh,

Modern Siem Reap-Angkor International Airport,

Growth of eco-tourism, MICE travel, river tourism, and coastal destinations.

Ecosystem Supporting Tourism Growth

New expressways and highways linking Phnom Penh with the coast and Siem Reap.

Rapid expansion of hotels, resorts, condotels, retail centres, and entertainment clusters.

Emerging integrated tourism zones, especially around Siem Reap and Sihanoukville.

Techo International Airport’s Impact

TIA is expected to transform Phnom Penh into a regional gateway, increasing:

Direct long-haul flights,

Passenger volume,

Logistics activity and cargo movement,

Demand for hotels, serviced apartments, and residential housing near airport hubs.

How Tourism Boosts Real Estate

Hospitality: More hotels, condotels, mixed-use assets.

Residential: Demand for rentals rises with international workers and returning expats.

Commercial: Malls, F&B corridors, entertainment districts.

Industrial: Airport-adjacent logistics and warehousing.

3. Political & Geopolitical Landscape

Political Stability

Cambodia remains politically stable following the leadership transition to Hun Manet. Policy continuity is strong, and institutional reforms continue gradually. For investors, this is a major positive.

Chen Zhi / Prince Group Sanctions

Sanctions by the US and UK have raised concerns about governance and financial-system exposure. Key takeaways for investors:

Direct risk only if investing in Prince-linked entities.

Moderate systemic risk: reputational damage and higher compliance scrutiny.

The broader market remains intact.

Cambodia–Thailand Border Tensions

Clashes in 2025 disrupted trade and tourism flows. While tensions affected short-term visitor arrivals and border commerce, Phnom Penh and major urban markets remain largely insulated. Negotiations and regional diplomacy point to gradual de-escalation.

Global Tensions & Their Impact

Conflicts involving Russia–Ukraine, the Middle East, and shifting US–China dynamics affect Cambodia primarily through:

Higher energy and commodity prices,

Trade fluctuations and tariff risks,

Supply-chain reconfiguration that may benefit Cambodia as manufacturers diversify into ASEAN.

4. Legal Framework & Taxes: What Investors Must Know

Real Estate Ownership Rules

Foreigners may:

Purchase strata-title condominium units above the ground floor (up to 70% of total building ownership).

Hold long-term leases (50–99 years).

Use land-holding structures under professional legal guidance.

Foreigners may not:

Own freehold land directly.

Transaction Costs

Transfer Tax: 4%

Annual Property Tax: 0.1% over KHR 100 million property value

Unused Land Tax: 2%

Legal, valuation, and agency fees: 0.5–1% depending on structure

20% Capital Gains Tax (CGT) in 2026

This is the most significant regulatory update. CGT applies to the net gain from selling immovable property.

Mitigation Strategies:

Maintain documentation of purchase, renovations, and selling costs.

Consider longer investment horizons instead of quick flips.

Use professional tax advisory to optimise between Actual Cost Method and Standard Deduction Method.

5. Real Estate Market Outlook for 2026

Market Overview

The market is undergoing a healthy correction, primarily due to:

Oversupply in certain condo and commercial segments,

Slower credit growth,

Post-COVID adjustments.

Sector Breakdown

1. Residential

Oversupply in high-end condominiums.

Opportunity in mid-market condos, affordable housing, and truly prime residences in BKK1, Tonle Bassac, Koh Pich, and well-located riverfronts.

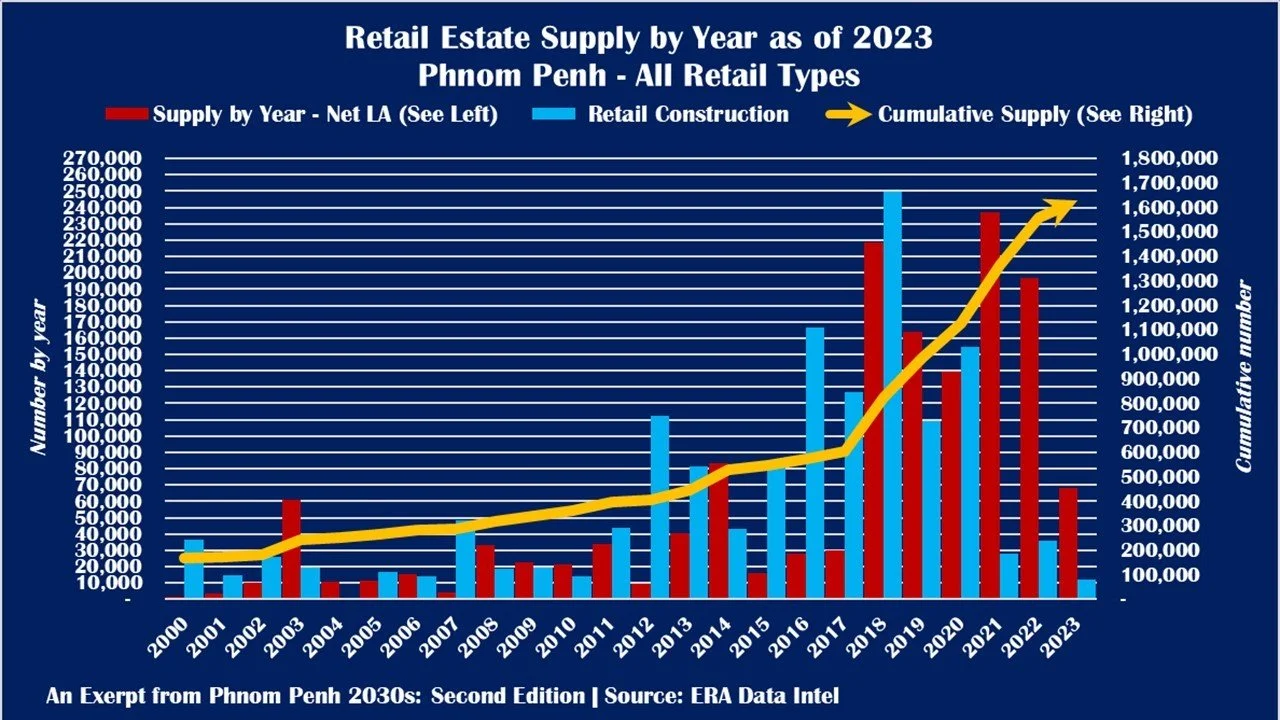

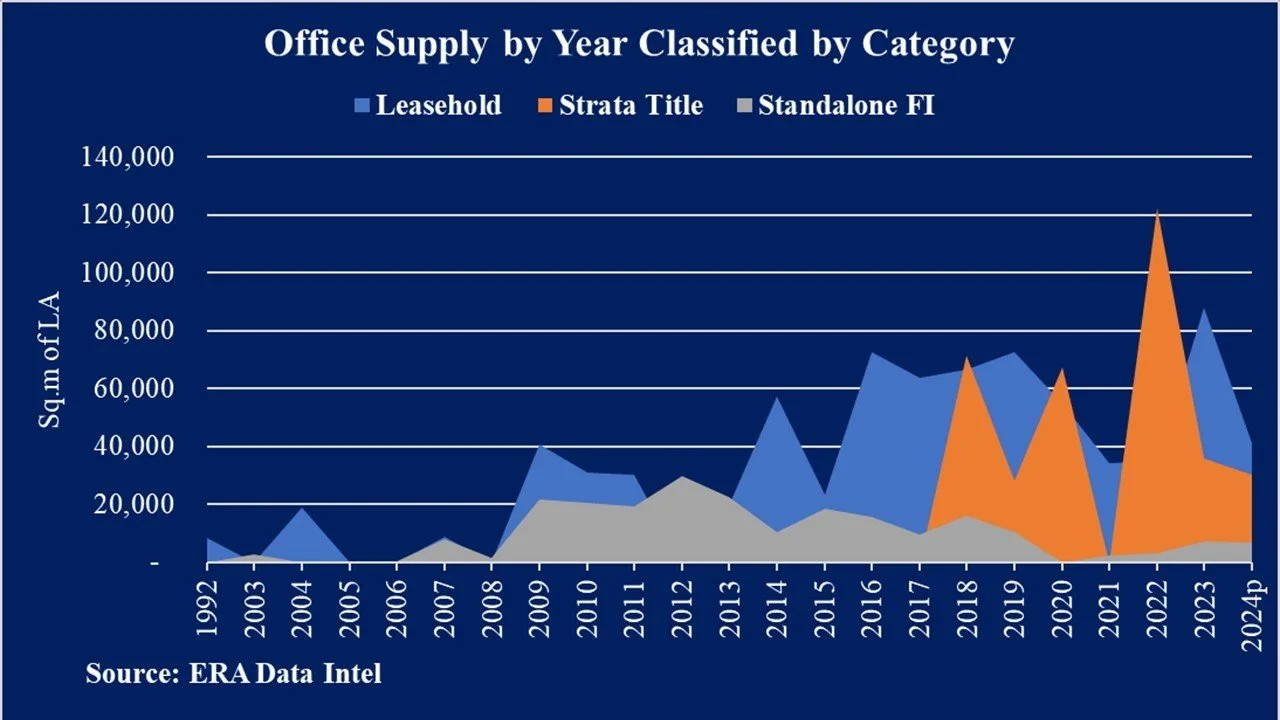

2. Commercial

Office vacancy remains high.

Retail stabilising, with prime malls performing better than strata commercial shophouses.

3. Industrial & Logistics (strongest sector)

Driven by manufacturing diversification and new transport infrastructure.

Logistics hubs around Techo International Airport, expressways, and special economic zones show strong long-term potential.

Where Opportunities Exist in Phnom Penh

Airport Corridor (TIA) — logistics, warehouses, worker housing

BKK1 / Tonle Bassac / CBD — luxury residences, serviced apartments

Chroy Changvar Peninsula — riverfront condos and mixed-use growth

Industrial Clusters — around National Road 4, ring roads, and expressways

Mid-market housing for the rising urban middle class

Is Phnom Penh a Safe Investment Destination in Uncertain Times?

Yes — conditional on asset selection and proper due diligence. Cambodia is:

Politically stable

Not directly exposed to military conflict

Supported by robust structural drivers (urbanisation, demographics, tourism, manufacturing shifts)

The key is strategic selection: quality developers, prime locations, compliance with tax/ownership rules, and real end-user demand.

Conclusion: 2026 Is a Reset Year — Not a Retreat Year

Cambodia’s real estate market is entering a new, more disciplined cycle. Investors who adapt to the upcoming 20% CGT, recognise shifting demand patterns, and focus on fundamentals — location, quality, management, and long-term value — will be well-positioned.

The opportunities remain compelling:

Tourism is rebounding,

Manufacturing is diversifying,

Infrastructure is expanding,

Demographics are favourable,

And urban Phnom Penh continues to evolve.

Smart investors are not stepping back — they are stepping in strategically, with sharper insights and stronger due diligence.

If you need guidance on identifying the most promising developments, evaluating risk, or navigating the 2026 tax landscape, I’m here to assist you.

Contact for Advisory

For a confidential consultation, please reach out:

Call: +855-10-699-553

Telegram: t.me/hoemseiha_era

WhatsApp: wa.me/85510699553

Line ID: hoemseiha

Email: hoem.seiha@eracambodia.com

More condo listings: t.me/seiha_era_condo_listing