A New Dawn for Real Estate? Economic Signals Point to a Stronger 2025

As we move through 2025, one question keeps surfacing in buyer and investor circles: Is the real estate market truly recovering — or is it just wishful thinking? Recent numbers suggest the optimism is well-founded. Several key economic indicators are aligning to support a steady revival in demand and transactions.

Here are 3 key signals that suggest a real estate comeback.

Number 1: Broad Money Signals: More Liquidity Means More Opportunity

Broad Money is a trusted barometer for the overall money available in an economy — it includes currency, checking accounts, and most importantly, savings deposits. In Cambodia’s context, this figure has shown remarkable growth.

Money supply increased marked in this decade.

Dec-2013: US$8 billion

Jan-2023: US$42 billion

Mar-2025: US$59 billion

This means that over the last decade, the total money supply has increased more than seven times.

What does this mean for real estate? When there’s more money in the system:

Banks have more deposits, so they can lend more to buyers and developers.

Households feel more financially secure, increasing their confidence to commit to large purchases like condos, townhouses, or even penthouses.

Developers can access funding to resume paused projects or launch new ones, expanding options for buyers.

In short, a robust broad money (M2) growth trend is a green light for real estate liquidity and activity. This explains why more buyers are coming back to the market this year.

Broad Money Growth Recovered, World Bank Suggests

According to World Bank's report issued in June 2025, broad money growth continued to gain momentum, rising by 19.0 percent in the 12 months ending March 2025, compared to 14.0 percent during the same period in 2024.

This acceleration is mainly driven by an increase in foreign currency deposits. Of the total 19.9 percent growth in broad money, foreign currency deposits (and other similar deposits) contributed the most, accounting for 14.0 percentage points, reflecting the high degree of dollarization in the economy. Transferable deposits contributed 4.6 percentage points, while currency in circulation added 0.4 percentage points during this period.

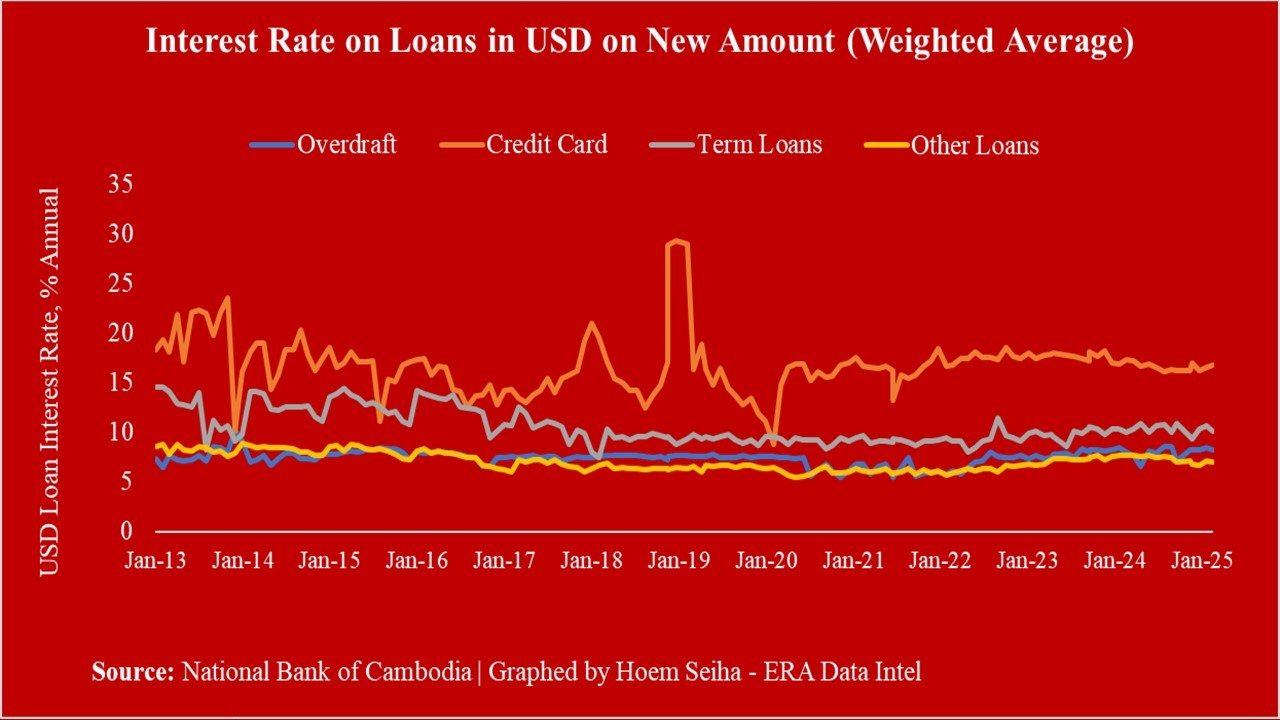

Number 2: Interest Rates: Affordability at the Core

Another critical factor behind real estate demand is borrowing cost. Even if people want to buy property, high interest rates can keep them on the sidelines.

Globally, rates spiked during the pandemic and the initial recovery phase to curb inflation. However, Cambodia has maintained relatively moderate rates:

> Residential mortgage rates hover around 7%–10% — attractive by regional standards.

> Rates have been stable for over 24 months, providing certainty for both new buyers and refinancing homeowners.

How does this benefit the market?

> Monthly repayments stay manageable, encouraging people to switch from renting to owning.

> Lower rates mean developers and businesses can borrow to invest in new projects.

> Investors can achieve better returns because rental yields often exceed borrowing costs — making real estate a safer bet than keeping cash idle.

In essence, supportive rates complement the abundant liquidity captured in the M2 growth — a double boost for recovery.

Number 3: Market Activity: Signs of a Turnaround on the Ground

The data is not just theoretical — it’s translating into real market behavior. Property agents, developers, and independent brokers are seeing clear signals:

Footfall at showrooms is rising: Buyers who were on the fence during the uncertain COVID years are now revisiting projects. More inquiries turning into real bookings: Especially in prime urban areas like Phnom Penh’s central business district and upcoming residential hubs. Developers reviving postponed projects: Several mid-tier condominium and mixed-use developments are back on track, confident that demand can absorb new supply.

Why this matters: A healthy property market depends on both supply and demand moving together. Higher liquidity and affordable financing help buyers, but real momentum comes when developers respond by delivering quality options. This balance is returning in 2025 — and it’s what makes this recovery look healthier than the speculative booms of the past.

How Should You React to This Positive Shift?

Here’s what this means for different players:

First-time buyers: This is a window of opportunity. Prices are still competitive compared to pre-pandemic highs, but the factors above suggest upward pressure could return soon. Securing a unit now locks in value and financing at favorable terms.

Investors: A recovering market with improving rental demand and stable mortgage costs offers an attractive yield spread. Focus on projects with proven track records and locations that align with new infrastructure growth.

The steady rise in broad money, the persistently low interest rates, and the visible uptick in on-the-ground transactions all paint the same picture: Cambodia’s real estate market is entering a new cycle — with firmer foundations than before.

While no market is without risks, these trends suggest that the next two to three years could reward proactive buyers and investors.

Have you observed this recovery firsthand? Are buyers asking more questions? Are developers offering new incentives? Share your experiences or drop your questions in the comments — and don’t forget to follow for my next deep dive on where smart money is moving next in Phnom Penh’s property scene!

[Contact for Consultancy]

Analog call: 010-699-553 / +855-12-699-553

Telegram: http://t.me/Hoemseiha

WhatsApp: https://wa.me/85510699553

Line ID: hoemseiha

Email: hoem.seiha@eracambodia.com

Condo listings on Telegram channel: https://t.me/seiha_era_condo_listing