Situation Update: Cambodia’s Real Estate Market & Prospect 2026: A Data-Driven Outlook Amid Border Tensions, Local Reforms and Global Uncertainties

Cambodia enters 2026 at a pivotal point in its real-estate cycle. After a decade of rapid expansion, the market is transitioning into a more disciplined and selective phase—shaped by slower but positive economic growth, regulatory reform, new infrastructure, and evolving regional dynamics.

This article provides a data-driven assessment of Cambodia’s real-estate outlook in 2026, integrating macroeconomic trends, tourism dynamics, legal and tax reforms, and sector-specific strategies for investors.

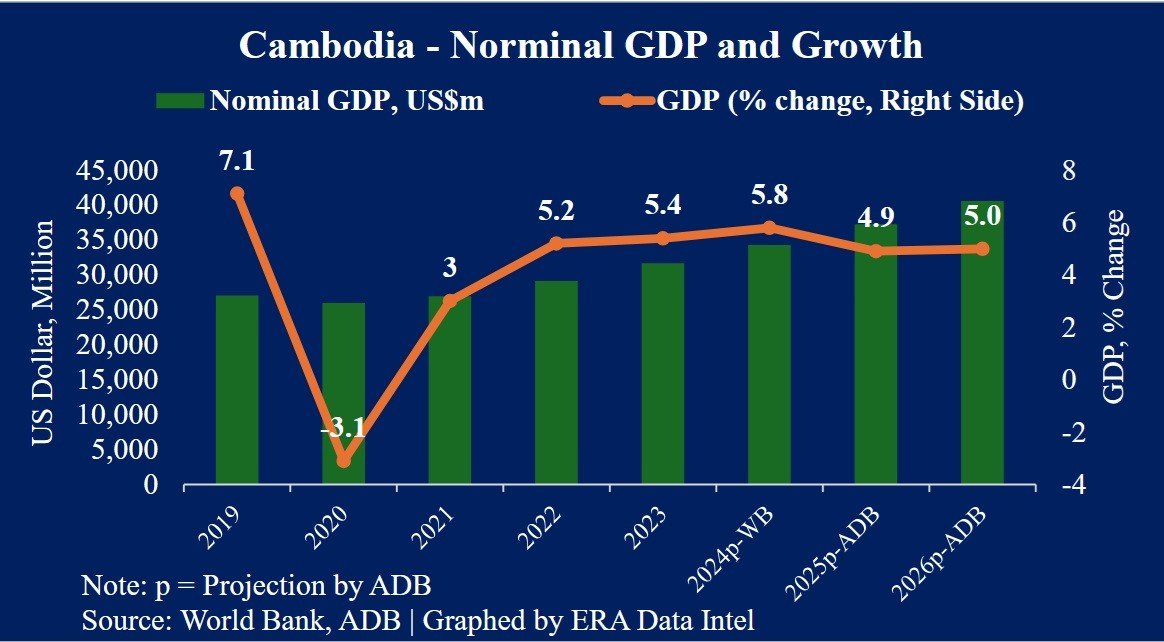

1. Macroeconomic Outlook: Growth Continues, Momentum Normalises

Cambodia remains one of Southeast Asia’s faster-growing economies, but growth is moderating from its pre-pandemic pace.

2010–2019: Average GDP growth of 6–7%

2023–2024: Post-COVID recovery above 5%

2026 outlook: ~4.5–5.0%, based on IMF and ADB projections

This moderation reflects global trade uncertainty, softer tourism momentum in 2025, and tighter financial conditions linked to property-sector adjustment. Importantly, this is not a recessionary scenario, but a normalisation phase where investment performance depends more on asset fundamentals than market momentum.

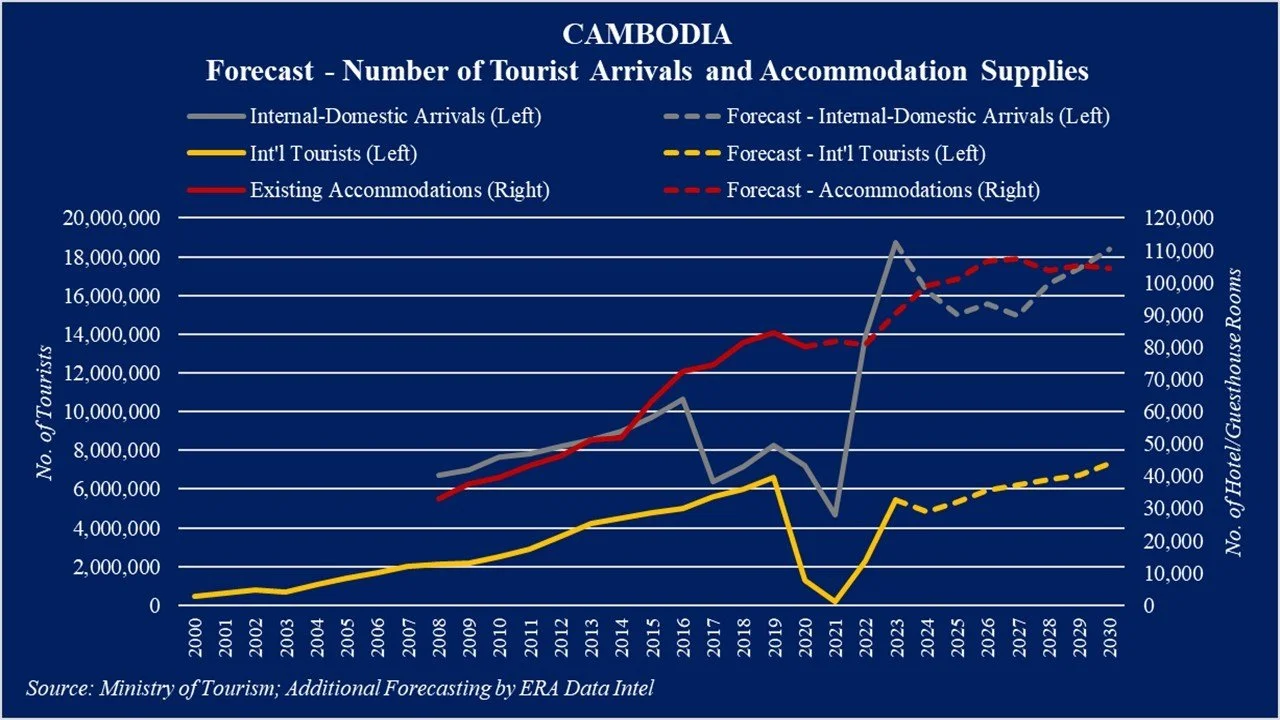

2. Tourism: Recovered, Adjusted, and Moving Toward Stabilisation

> Recovery Achieved

Cambodia’s tourism sector demonstrated strong resilience:

2019: ~6.6 million international visitors

2023: ~5.45 million

2024: ~6.7 million — effectively back to pre-COVID levels

This recovery supported employment, hospitality revenues, and rental demand in Phnom Penh, Siem Reap, and coastal markets.

> 2025 Adjustment

Official data shows year-on-year declines in parts of 2025, driven by:

Cambodia–Thailand border tensions affecting short-haul travel

Heightened international scrutiny related to scam-economy enforcement

Broader global uncertainty dampening discretionary travel

These headwinds are largely cyclical, not structural.

> 2026 Outlook

Most government and industry expectations point to stabilisation in 2026, with arrivals likely to:

Base case: ~6.7–7.1 million

Upside case: ~7.1–7.5 million if regional conditions improve

Key structural supports include:

Techo International Airport, operational from late 2025

Siem Reap–Angkor International Airport

Continued diversification toward China, ASEAN, and eco-tourism

Strong domestic tourism cushioning volatility

3. Infrastructure: Aviation as a Long-Term Catalyst

Techo International Airport fundamentally changes Cambodia’s tourism and logistics capacity:

Phase 1 capacity: ~13 million passengers/year

Future expansion to 30 million and 50 million passengers

While aviation capacity alone does not guarantee higher property prices, it raises the long-term ceiling for:

Hospitality and serviced apartments

Retail and lifestyle assets

Industrial and logistics developments along airport and expressway corridors

4. Politics, Geopolitics, and Risk Perception

Cambodia remains politically stable, with strong policy continuity.

Recent challenges—including border tensions and international sanctions linked to scam-economy enforcement—have affected sentiment and compliance processes, but:

Core urban markets remain insulated

Risks are primarily confidence-based, not systemic

For investors, this underscores the importance of counterparty due diligence, not market withdrawal.

5. Legal & Tax Reforms: A More Mature Market Framework

Key developments shaping 2026 investment strategy:

Foreign ownership of strata-title condominiums remains permitted

4% transfer tax continues to apply

20% Capital Gains Tax (CGT) on property sales effective January 2026

CGT encourages:

Longer holding periods

Yield-focused investment

Greater emphasis on asset quality and liquidity

This aligns Cambodia more closely with other ASEAN property markets.

6. Real-Estate Market Fundamentals: From Expansion to Selection

Residential Condominiums

Phnom Penh condo stock has expanded sharply since 2019

Oversupply exists in certain investor-driven segments

Resilience remains in prime locations, well-managed buildings, and practical unit sizes

Landed Housing

Borey developments perform best when aligned with local affordability

Speculative fringe developments face slower absorption

Industrial & Logistics

This is the strongest-performing segment across scenarios, supported by:

Airport infrastructure

Supply-chain diversification

Manufacturing and logistics demand

Hospitality & Serviced Apartments

Short-term volatility suggests conservative underwriting, but long-term fundamentals remain supported by improved connectivity and urbanisation.

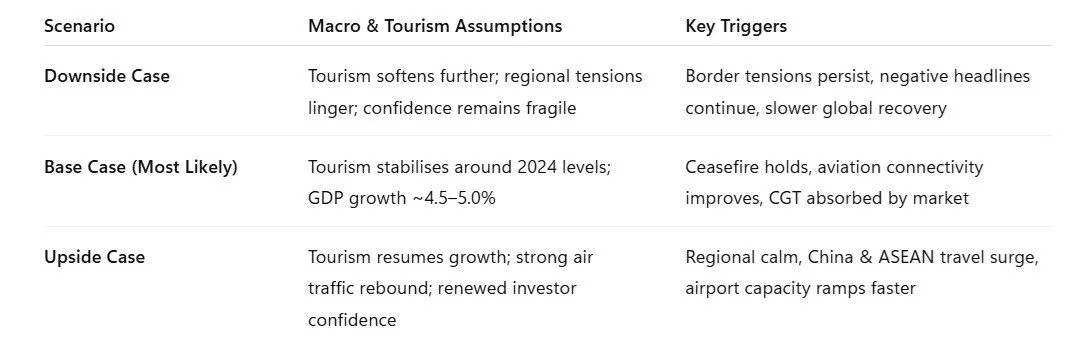

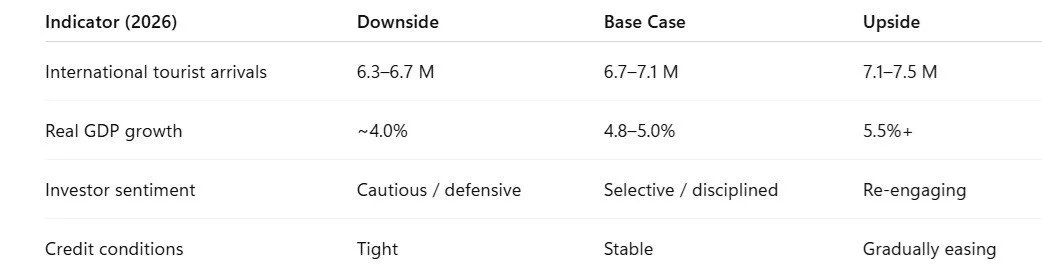

7. 2026 Scenario Matrix: Strategy by Asset Type

Macro & Tourism Scenarios

Downside: Tourism 6.3–6.7M | GDP ~4.0%

Base case (most likely): Tourism 6.7–7.1M | GDP ~4.8–5.0%

Upside: Tourism 7.1–7.5M | GDP >5.5%

Strategic Implications

Condominiums: Income-focused, prime-only selection

Luxury residences: Scarcity and long-term capital preservation

Serviced apartments: Selective positioning near business and tourism nodes

Landed housing: Mid-market, end-user driven projects

Industrial & logistics: Core allocation across all scenarios

Scenario Matrix Overview

Tourism & Macro Indicators by Scenario

Conclusion: 2026 Is a Selection Market, Not a Retreat

Cambodia’s real-estate market in 2026 is best understood as a discipline-driven cycle:

Economic growth continues at a sustainable pace

Tourism has recovered, adjusted, and is stabilising

Infrastructure investments strengthen long-term fundamentals

Legal reforms promote transparency and maturity

For investors, success in 2026 will depend on quality, income visibility, and risk management—not speculation.

This is not a market to exit, but one that rewards precision, patience, and professional analysis.

Contact for Advisory

For a confidential consultation, please reach out:

Call: +855-10-699-553

Telegram: t.me/hoemseiha_era

WhatsApp: wa.me/85510699553

Line ID: hoemseiha

Email: hoem.seiha@eracambodia.com

More condo listings: t.me/seiha_era_condo_listing